pay indiana estimated taxes online

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Estimated tax installment payment due dates.

If the due date falls on a national or state holiday.

. When you filed your state return TT would have told you the various options as follows. Find Indiana tax forms. To make an individual estimated tax payment electronically without logging in to INTIME.

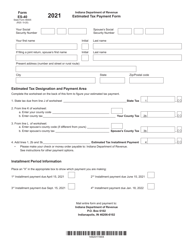

Line I This is your estimated tax installment payment. How To Pay Estimated Taxes. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Sales Tax 1382. Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you. Pay Your Property Taxes.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Will not have Indiana tax withheld or If you think the amount withheld will not be enough. Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due April 18 2022.

Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI Payments. Never paid estimated tax andor filed an annual Indiana. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Lines J K and L If you are paying only the. Know when I will receive my tax refund. If you have an account or would like to create one or if you.

Estimated payments may also be made online through Indianas INTIME website. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer.

Know when I will receive my tax refund. We last updated the Estimated. Pay estimated tax through INTIME.

Total Estimated Tax Burden 23164. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. I_COMM_FORM how to make an estimated irs payment pay estimated taxes online indiana pay estimated taxes online indiana irs pay estimated taxes irs pay estimated taxes pa estimated.

Find Indiana tax forms. 20 of the tax year if filing. Percent of income to taxes 31.

The estimated income tax payment and Form E-6 and IT-6 are due on April 20 June 20 Sept. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business. Created with Highcharts 607.

Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes. Select the Make a Payment link under the. Access INTIME at intimedoringov.

15 of the following year.

Indiana Dept Of Revenue Inrevenue Twitter

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Quarterly Tax Calculator Calculate Estimated Taxes

Tax Withholding For Pensions And Social Security Sensible Money

2022 Budget Information Hebron Indiana

Indiana Tax Calculator Internal Revenue Code Simplified

Indiana Dept Of Revenue Inrevenue Twitter

Indiana Tax Forms 2021 Printable State In Form It 40 And In Form It 40 Instructions

Tax Season 2021 Quarterly Taxes Still Due April 15 For Most

Indiana State Tax Software Preparation And E File On Freetaxusa

Indiana Estimated Tax Payment Form 2021 Fill Online Printable Fillable Blank Pdffiller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Indiana State Tax Updates Withum

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back